Top 10 Online Payment Processing platforms

January 30, 2025 | Editor: Sandeep Sharma

16

Online checkout platforms allow to accept money via different payment options.

1

Accept credit cards on your iPhone, Android or iPad. Send invoices free with Square Invoices. Signing up for Square is fast and free, and there are no commitments or long-term contracts like with alternative services.

2

Stripe builds the most powerful and flexible tools for internet commerce. Whether you’re creating a subscription service, an on-demand marketplace, an e-commerce store, or a crowdfunding platform, Stripe’s meticulously designed APIs and unmatched functionality help you create the best possible product for your users.

3

Authorize.Net provides payment solutions that save time and money for small- to medium-sized businesses and organizations. Accept credit cards and electronic checks securely and easily from your website. Solutions range from simple Buy Now buttons to more sophisticated subscription and tokenized payment products.

4

The payments platform built for any business and every customer journey. End-to-end payments, data, and financial management in a single solution.

5

CyberSource is a flexible, secure commerce solution that allows to sell online almost anywhere in the world, instantly boosting your customer reach. Accept the payment types preferred in local markets, transact payments in over 190 countries and fund in 21 currencies, all through a single connection.

6

Some of the fastest growing companies in the world rely on us to process mobile and web payments. Elegant code. Drop-in checkout. Secure, client-side integration. Zero-hassle PayPal integration will be available soon. Mobile payment processing designed to keep the checkout flow streamlined.

7

A digital wallet that makes managing your money quick, easy and secure. You can trust NETELLER for fast and secure online payments. Paying with NETELLER is always instant, secure and free.

8

The all-in-one monetization platform that maximizes your revenues and makes global online sales easier. It allows to sell globally and reach a truly international audience. 2Checkout gives your customers the option to select from any of 15 languages and 26 currencies through the checkout process giving them a familiar and comfortable experience.

9

Amazon Pay allows Amazon customers login and pay on your website with their stored account information on Amazon.com. Login and Pay with Amazon can help you add new customers, increase sales and turn casual browsers into buyers. It’s fast, easy and trusted — leverage the Amazon brand to grow your business.

10

Checkout.com is a payment processing platform with real-time insights, centralized reconciliation tools and complete feature parity across multiple geographies. All through one unified API. High-performing businesses choose Checkout.com to boost acceptance rates, fight fraud, and create extraordinary customer experiences.

11

QuickBooks Payments allows to accept all kinds of payments, all in one place. Take payments via cards, ACH, Apple Pay, PayPal, and Venmo. No matter how you get paid, manage it all in QuickBooks so you never miss a thing.

12

WePay is an online payment service provider powered by JP Morgan Chase. Powerful integrated payments for any business model. WePay's payment API focuses exclusively on platform businesses such as crowdfunding sites, marketplaces and small business software.

13

PayPro Global is an E-commerce Platform for selling software, digital goods and Saas online. Flexible solution, Over 70 payment methods, Great support.

14

BlueSnap is a global payment platform that delivers a better return on investment by reducing costs and improving authorization rates no matter where you sell. With a single integration, you get access to our proprietary Intelligent Payment Routing, 100+ currencies and 100+ payment types, local card acquiring and our entire suite of optimization tools.

15

Zoho Checkout allows to build a custom, branded payment page in a matter of minutes and start accepting payments right away.

Important news about Online Payment Processing platforms

2024. PayPal launches Tap to Pay on iPhone for business

PayPal has announced the rollout of "Tap to Pay" for merchants utilizing iPhones through the Venmo and Zettle applications in the U.S. This feature, facilitated by PayPal, enables businesses to accept contactless card and digital wallet payments directly on their iPhones without incurring extra expenses or requiring additional hardware. Following its introduction for Android phone merchants eight months prior, Tap to Pay allows merchants not only to accept payments from cards or digital wallets such as Apple Pay or Google Pay but also to incorporate taxes, receive tips, issue receipts and process refunds seamlessly. PayPal assures that funds from transactions are promptly deposited into the merchant's Venmo or PayPal Zettle account. For each sale via the tap-to-pay method across Zettle and Venmo, PayPal applies a charge of 2.29% + 9¢.

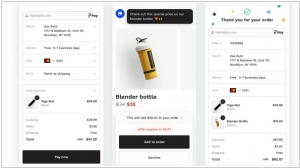

2023. Rally bags $12M to build the future of e-commerce checkout

Rally, a composable checkout platform for e-commerce merchants, has raised $12M. Rally has divided its operations into two parts. The first aims to assist traders by integrating with commercial tools such as Salesforce Commerce Cloud, Magento and BigCommerce. The second part provides merchants with a "headless" ecosystem that allows them to change either the front or back end of their website without affecting the other. While Rally's CEO did not disclose any specifics, he stated that the company is nearing a partnership announcement with front-end and back-end experts to provide headless-as-a-service.

2023. Paytrix raises $18.3M to build out its one-stop payments shop

UK startup Paytrix has raised $18.3 million to build a solution to fix this: a single platform — and single contract — that lets its customers manage all of the different payments options from payment acceptance to payouts, in one place. Paytrix describes itself as a “payments curation” platform and behind an API that it provides to its customers to integrate into their own services, it negotiates its own banking relationships in different countries, which lets it bypass the traditional payment rails used for card payments and other payment services like Stripe, as well as some of the newer channels that have been emerging in more recent years, such as open banking standards.

2021. Silverflow nabs $17M for its updated, cloud-based take on payments processing technology

When it comes to online payments, the front end of the system has experienced significant disruption in recent years, with companies like Stripe, Adyen, PayPal, Square and others developing APIs that make it very straightforward for online merchants to integrate seamless payment services into their checkout processes. Silverflow, which has created a new approach to this with an API for data-driven payment processing, is announcing $17 million in funding. The essence of what it is doing is offering a highly advanced alternative to traditional processing systems, with a broader range of additional services integrated around the payments, by reconstructing them as data-driven networks in the cloud.

2021. South African payments gateway Ozow raises $48M

Digital payment gateways, on the other hand, serve a distinct purpose, especially when they enable people to use their basic bank accounts for transactions. Ozow is one such provider. After a year of rapid growth, it has secured $48 million in Series B funding to offer more alternative payment solutions to its millions of merchants and consumers. Ozow streamlines the payment process. All merchants need is a bank account and a “smart-enabled device” to accept payments. Ozow’s clients include major enterprises, such as MTN, Vodacom, Shoprite Group, Takealot and Uber. Ozow is free for individual users and merchants can also utilize the payment gateway for free during the first 12 months, or up to $65,000 in processing value per month.

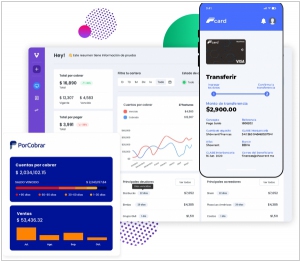

2021. Yaydoo secures $20M, aims to simplify B2B collections, payments

Mexico-based B2B software and payments company Yaydoo has announced the completion of a $20.4 million Series A round. The company offers three products—VendorPlace, P-Card and PorCobrar—for managing cash flow, optimizing access to smart liquidity and connecting small, medium and large businesses to a suite of digital tools. The new funding will allow the company to attract new talent in Mexico and support its expansion into other Latin American countries. Yaydoo is also exploring future opportunities for its working capital business, such as understanding how many invoices customers are sending, the access to actual payments and how money moves in and out to provide insights on working capital funding gaps. The company will also allocate funds to product development.

2021. Square acquires buy-now, pay-later company Afterpay for $29 billion

In a move that could only be described as galactic in scale—at least by Australians—Square has rather nonchalantly agreed to gobble up Afterpay, the local champion of the buy-now, pay-later universe, in an all-stock deal casually valued at a jaw-dropping $29 billion. Naturally, this makes it one of Australia’s most audacious corporate maneuvers in recorded history. Square, with the calm demeanor of a being who knows exactly where their towel is, plans to integrate Afterpay into its twin tech titans: Cash App and Seller. Cash App, the digital equivalent of a Babel fish for money transfers, will let users juggle their Afterpay payments without breaking a sweat. Meanwhile, Seller—Square’s shopkeeper-friendly sidekick—will allow merchants to sprinkle the magic of Afterpay into their retail offerings, making "later" seem suspiciously like "now" to the average customer.

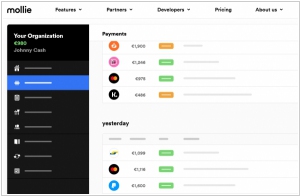

2021. Dutch payments startup Mollie raises another $800M

In a somewhat baffling turn of events that could make even the most jaded intergalactic hitchhiker blink, Mollie—an Amsterdam-based startup that helps businesses casually slide payments into websites, documents, and assorted virtual whatnots with an API—is celebrating a colossal $800M raise. Mollie’s not exactly the sole horse in the payments race; the market is positively bursting at the seams with the likes of JP Morgan, WorldPay, Fiserv (First Data), and PayPal muscling in at the top. Shockingly, familiar names like Stripe aren’t even in the top 10, leaving Mollie with more room to grow than an interstellar traveler's list of detours, and reminding us all just how absurdly vast the financial landscape truly is.

2021. Stripe acquires TaxJar to add cloud-based, automated sales tax tools into its payments platform

Imagine if you will, that the rather unassuming yet quietly omnipresent entity known as Stripe—the sort of payments company that has slipped so seamlessly into the background that you scarcely realize it’s there, but also happens to be one of the largest privately-held ones—has decided to snatch up TaxJar. Now, TaxJar is no ordinary tax service; it’s a cloud-based wizard of fiscal headaches, proficient in the dark arts of automatically calculating, reporting, and filing sales taxes across variously mystifying geographies and tax systems. Picture it as an interstellar tour guide for online businesses who would rather avoid the black hole of multi-state tax confusion. Stripe, always the enterprising sort, plans to weave TaxJar’s arcane technology into its own revenue platform, snugly settling it beside Stripe Billing (for those pesky subscription needs) and Radar (its vigilant, fraud-spotting sentinel). Not only that, but Stripe might also, in true forward-thinking fashion, deploy AI and other curious technologies to automate all manner of complex revenue tasks. And yet, despite all this integration, TaxJar remains its own quirky entity—you can still summon it directly if you prefer to tackle your tax woes the old-fashioned way.

2021. Shopify expands its payment option, Shop Pay, to its merchants on Facebook and Instagram

Freelancers who collaborate effectively in teams are the focus for Collective, a French startup that’s launching a SaaS marketplace. Collective contends that the indie ‘collectives’ trend has only been accelerated due to the coronavirus pandemic— with companies facing more uncertainty seeking more resilient and flexible solutions. For teams of skilled independent workers, the appeal of Collective lies in its promise to merge the advantages of working in an agency—because its SaaS platform automates numerous back-office functions like proposals, invoices, contracts and payments—with the flexibility of remaining freelance and thus able to select projects and clients.