Top 10 Expense Management software

February 01, 2025 | Editor: Michael Stromann

16

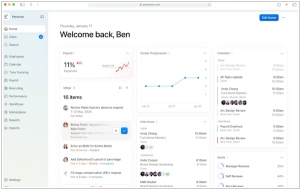

Spend management software that automates the creation of the expense report for employees, provides online review and approval process for managers.

1

SAP Concur's easy-to-use business travel and expense management software solution helps your business save time, money and gain control. The Concur booking tool makes business travel a snap—starting with customized options that align with your company policies. You can also upload electronic folios, directly to expense reports. Concur provides full visibility into spend and the ability to ensure policy and regulatory compliance.

2

Simplified expense reporting your employees will love. Streamline the way your employees report expenses, the way expenses are approved, and the way you export that information to your accounting package.

3

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, procurement, and employee expenses to run your business more efficiently and drive growth.

4

Bill.com brings smart AP and AR automation and new bill payment capabilities to your business. The intelligent way to create and pay bills, send invoices, and get paid.

5

Certify is the leading cloud-based travel and expense report management solution for companies of all sizes. Certify makes expense reports easy by automating the creation of the expense report for the employee, providing online review and approval process for managers, and streamlining the processing and reimbursement process for accountants.

6

Expense Management & Business Budgeting Software. Simplify your business' expense reports with Divvy. Submit expense reports, budget, reimburse employees, and manage virtual cards right from Divvy's platform.

7

Emburse Tallie helps small businesses focus more on work with impact—and less on paperwork for managing expenses.

8

Real Time Expense Reporting. Abacus is the easiest way for you to automate how you reimburse your team, reconcile corporate credit cards, and implement your expense policy.

9

Expense reporting doesn't have to be painful. Zoho Expense is a perk for employees, managers, and finance teams. Automate travel and business expense reporting, streamline approvals, gain spend visibility and control.

10

Rydoo is an all-in-one Travel & Expense platform. Book business trips and submit or approve expense claims in real time.

11

Expense management software + AP automation. Automate your expenses, invoice processing + more with our digital business management systems.

12

Teampay gives your organization an intuitive workflow and reporting for purchases. This adds security, accountability, and easy approval while giving employees autonomy over their purchasing process.

Important news about Expense Management software

2024. Paylocity is acquiring corporate spend startup Airbase for $325M

HR and payroll software company Paylocity has acquired corporate spend startup Airbase for $325 million. Airbase was founded in 2017 to provide software to midsized companies seeking to better manage their spending. Its platform included bill payments, corporate cards and employee reimbursements, among other things. The company over the years has competed with the likes of Ramp and Brex, with a focus on selling software from its early days. At one point, it said it surpassed “eight figures” in annual recurring revenue (ARR), although the company has not shared exact numbers. Paylocity in a statement said the addition of Airbase would help it expand its total addressable market beyond human capital management (HCM) and “further into the office of the CFO.”

2022. Sava, a spend management platform for African businesses, gets $2M

Sava, the South African fintech that enables small businesses to oversee their expenditures, has secured $2 million in pre-seed funding. Sava, which has yet to launch, claims it integrates bank accounts, mobile wallets, payment systems and accounting tools all within a single platform. Sava emphasizes two particular challenges businesses face with spending management and reconciliations. First, businesses lack tools to effectively control their expenditures. Second, business owners and their teams invest significant time in manual record-keeping and reconciliations and do not have adequate data for prudent lending decisions.

2022. European spend management platform Moss raises $86M

Berlin-based startup Moss has secured a new $86 million Series B funding round (€75 million). The company provides corporate credit cards for small and medium-sized businesses so they can more easily make purchases and monitor their expenses. Moss can be seen as a spend management platform. It competes with other European firms, such as Spendesk, Pleo and Soldo. What differentiates Moss from its rivals is that it offers credit cards instead of debit cards. However, transactions still appear in your Moss dashboard moments after each payment.

2021. Pleo picks up $200M to build the next generation of business expense management

Danish startup Pleo, a creator of expense management solutions targeted at SMBs to allow them to issue company cards and better oversee employee spending, has secured $200 million. Many companies developing similar products have primarily focused on large enterprises as their customers. (However, this is rapidly changing: another significant player in the same field as Pleo, Soldo, raised $180 million this year as well.) Pleo’s offerings now include card issuance, invoice payments and out-of-pocket expenses, integrating all of these with existing accounting systems to facilitate smoother financial management. Pricing begins with a free and limited tier for the smallest clients, up to five users and scales to £10 per person per month for larger clients, along with packages tailored for the largest users.

2021. Mendel secures $35M to tackle LatAm’s corporate spend management problem

Mendel, a corporate expenditure management solution for businesses in Latin America, announced today that it has secured $35 million in debt and equity. Mendel’s goal is clear: to transform corporate expenditure management by automating most of the tasks for a company CFO that are currently done manually. In simpler terms, it aims to be a one-stop shop for all B2B spending. The corporate expenditure sector is becoming increasingly crowded. Ramp and Brex have both raised substantial funding this year and TripActions shifted last year beyond travel to general expense management. Divvy was acquired by Bill.com.

2021. PayEm raises $27M for its answer to the expense report

PayEm, an Israeli firm that develops spend and procurement platforms for high-growth and multinational companies, has raised $27 million. The company’s technology streamlines the reimbursement, procurement, accounts payable and credit card processes to handle all requests and invoices while also generating bills and sending payments to over 200 countries in 130 different currencies. It provides finance teams with a real-time view of what items employees are requesting funds to purchase and what is actually being spent. For instance, teams can submit a request and go through a customizable approval workflow with purchasing codes linked to a description of the transaction. Simultaneously, all transactions are continuously reconciled, eliminating the need to spend hours at the end of the month sorting through paperwork.

2021. Spendesk raises $118 million for its corporate spend management service

French startup Spendesk, specializing in spend management, has raised $118 million. Initially launched in the startup studio eFounders, the company first provided virtual and physical corporate cards for employees. While corporate cards are quite prevalent in the U.S., many small and medium-sized businesses in France cannot issue a card to every single employee. By integrating a SaaS platform with corporate cards, Spendesk creates numerous possibilities. For example, you can establish an approval process for significant purchases and allocate different budgets for various teams. Over time, Spendesk has broadened its services beyond cards to include expense management and invoice processing. It also aims to automate repetitive accounting tasks, such as reminding employees to attach receipts for each transaction. Everything can be exported to Xero, Datev, Sage, Cegid, or Netsuite.

2021. Soldo raises $180M for its business expense management platform

In a move that would surely make Marvin the Paranoid Android raise an eyebrow (if he had one), Zoho Invoice has decided to fling the concept of cost into the nearest black hole, offering its services absolutely free for all small and medium-sized businesses. This, of course, is not a result of a malfunctioning improbability drive but a deliberate and rather enthusiastic commitment to the SMB community. The ever-busy developers, possibly sipping tea and pondering life, the universe, and everything, will continue to tinker away, adding features and updates to make invoicing as refreshingly simple as a sunny day on Magrathea.

2021. Pleo raises $150M for its new approach to managing expenses for SMBs

Startup Pleo, which has developed a comprehensive system encompassing payment cards, expense management software and integrated reimbursement and payout services, has secured $150 million. Approximately 17,000 small and medium-sized businesses currently use Pleo, with medium-sized companies typically employing around 1,000 people. The sector includes several companies, from established players like SAP’s Concur to startups nearing an IPO like Expensify, as well as newer entrants introducing innovative technologies. However, Pleo’s strategy has been to create, from scratch, a system tailored for smaller businesses that consolidates all stages of employee spending on behalf of the company.

2021. All-in-one expense management platform Jeeves raises $131M

Jeeves, which is developing an “all-in-one expense management platform” for global startups, is emerging from stealth today with $131 million in total funding. The “fully remote” Jeeves positions itself as the first “cross-country, cross-currency” expense management platform. The startup’s solution is currently operational in Mexico — its largest market — as well as in Colombia, Canada and the U.S. and is in beta testing in Brazil and Chile. Jeeves asserts that by utilizing its platform, any company can establish their finance operations “in minutes” and gain access to 30 days of credit on a true corporate card, non-card payment options and cross-border transactions. Customers can also repay in various currencies, minimizing foreign transaction (FX) fees.